Why SimLex accounting system is used by many users

More than 90% of customers who have purchased a production management system, sales management system, inventory management system, or P/O invoice system have purchased SimLex Accounting. Here's why.

Accounting software is approved by Thai Revenue Department and 100% compatible with Thai taxation

SimLex Accounting is a BOI-compatible accounting software developed by a Japanese company in Thailand and is approved by the Thai Revenue Department, so Thai staff can use it with confidence. It also supports Indonesian accounting standards. Of course, since it is an approved software, it is 100% compatible with Thai taxation.

Multi-language and multi-currency support

SimLex Accounting supports Japanese, English, and Thai in multiple languages, making it easy for Japanese people to use. For reports, account names can be printed in three languages. SimLex Accounting system also supports the cloud, so you can use it in Japanese from Japan.

Automatic journal of sales, purchases, fixed assets, etc. and be able to do monthly and annual closings early

Journal data of sales and purchase is automatically generated by Invoice approval. In addition, Fixed assets corresponds to the depreciation rules of Japan, Thailand, and Indonesia, and automatic journal is generated at the end of the month.

Real-time journal entry and real-time inventory management are important for financial statements, and SimLex Accounting achieves these. Monthly Statement is finished within 5-10 days of the next month, and annual statement is finished within 1-2 months of the next year.

Correspondence of four methods of E-TAX in Thailand

Currently, there are four methods of E-Tax implementation notified by the Thai Revenue Department. SimLex recommends format 1 or 3, and is actually used by customers.

1. E-TAX By E-MAIL: Method using E-MAIL.

2.E-TAX UPLOAD: A method of uploading an xml file to the Revenue Department.

3. E-TAX PROVIDER: A method of using a service provider. (Reference) https://www.getinvoice.net/

4. E-TAX Host to Host: A method of directly connecting the company's server and the revenue bureau's server, and passing files directly from the company's server.

(Reference) https://etax.rd.go.th/etax_staticpage/app/index.html#/index/main#top

The registration website is here. https://www.thaidigitalid.com/homepage/

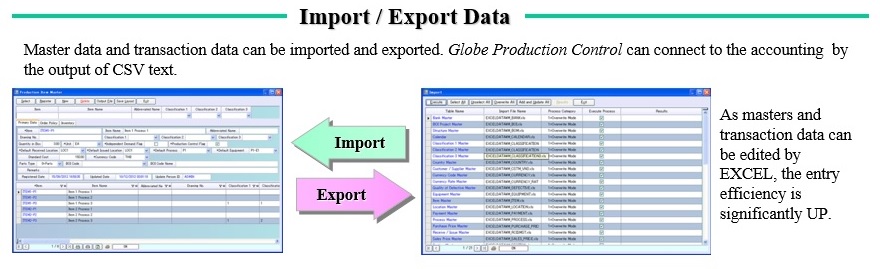

Collaboration with EXCEL

Master and transaction data can be imported with large amounts of data.

Any data displayed on the screen can be exported to Excel.

All reports can be output to Excel or PDF files.

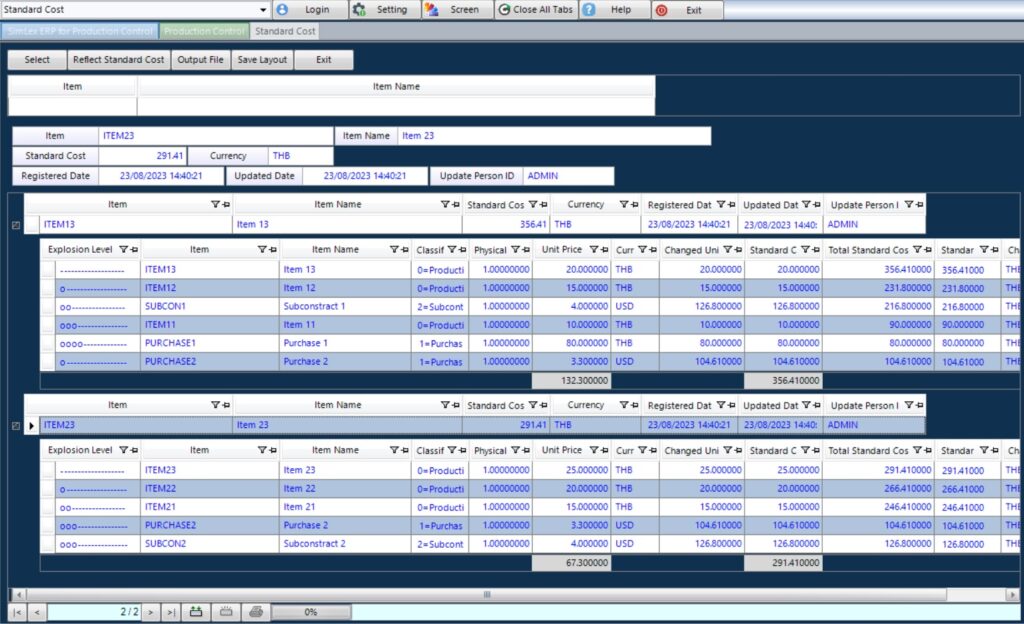

When SimLex Accounting is used with SimLex ERP or production control , it is enable to calculate production cost.

If you use SimLex in your factory, you can easily connect it to SimLex ERP or SimLex Production Control and manage the cost control systems. In this case, it is necessary to implement departmental accounting on the accounting system side. Automatically perform standard, actual, and budget cost in minutes from expense data in your accounting system

Functional overview of SimLex Accounting System

SimLex Accounting System is developed according to Thai and Indonesian Standard Accounting.

Sales System are included Invoice/Advance/Debit Note/Credit Note、Purchase and Subcontract Invoice/Advance/Debit

Note/Credit Note it's automatically transaction.

Journal entry, Voucher entry, Received Entry, Payment Entry and various forms will be displayed and manual journal can be entered.

Submission for VAT to tax office of Thailand、Withholding Tax can be printed.

Accounting System

SimLex Accounting System supports Voucher Entry, Received Entry, Payment Entry, Bank Transaction Entry, Fix Assets, Recurring Entry, AR Control, AP Control, Debit Note, Credit Note and various reports.

- In Voucher Entry, you can enter Debit Data and Credit Data Simply. And Voucher Entry supports foreign currency.

Voucher Reports are Journal Voucher, AR Voucher, RV Voucher, AP Voucher, PV Voucher and various Journal Book. - In Received Voucher, you can enter AP journal or Received journal. In Payment Voucher, you can enter AP journal or Received journal. Each voucher create Vat journal or Withholding Journal. SimLex supports Unamortization Tax.

- In Bank Process, you can enter income or payment journal. SimLex supports the control of received cheque or payment cheque.

- In Thailand, as Fix Assets value is small money, Fix Assets Control is important. SimLex supports Straight Line Method and Declining Balance Method. If you enter the life and value, SimLex create monthly depreciation automatically.

In Monthly Process, SimLex creates Fix Assets journal automatically. As Fix Assets depreciation are too many, Automatic Process is important. - Recurring Process is for advance Payment. In Monthly Process, Recurring journal is created.

- As users can set Account name by 3 language (Example : English, Thai, Japanese), users can print various reports by selected language. And users can print reports for Thai Tax office.

Sales Control

Basic business flow is Quotation→customer's P/O input→Delivery Note→Delivery result→Invoice input. Customer P/O and Invoice are needed to Approve.

- Users can make a Quotation. If Item code dose not exist in Item Master, Item will be created automatically. After Quotation is created, Users can enter automatically from a Quotation.

- After you enter Customer P/O, Users can enter Delivery data and print Delivery Note. Users can spirit delivery quantity or enter plural Customer P/O as 1 Delivery Note.

- Users can print Invoice according to Delivery Note.

- Users can enter Advance. Debit Note or Credit Note is used for unit price adjustment.

- P/O, Delivery Reports are Confirm P/O Report, P/O Back Order Report, Weekly Delivery Schedule Report, Monthly Delivery Schedule Report.

- Accounting Receivable (AR) Reports are AR History Reports, Aged Receivable Detail / Summary, Debtor Card.

- Actual Sales reports are Actual Sales by Item, Actual Sales by Customer.

Purchase Control

Basic business flow is P/O Entry / Report→P/O Approval→Received Result Entry→Supplier Invoice Entry→Invoice Approval.

- SimLex supports foreign Currency and you can enter P/O. Purchase Price Mater supports expired date and unit price by lot size.

- After P/O is entered and printed, you can enter received result. SimLex supports to split received quantity.

- Users can enter Advance, Debit Note or Credit Note. Debit Note or Credit Note is used for unit price adjustment.

- Users can enter Advance. Debit Note or Credit Note is used for unit price adjustment.

- Purchase Reports are P/O Back Order Report, Merchandise Received Sheet for Item, Monthly Receive Schedule Report.

- Accounting Payable (AP) Reports are AP History Reports, Aged Payable Detail / Summary, Creditor Card.

- Actual Purchase reports are Actual Purchase by Item, Actual Purchase by Supplier.

Stock Control

Basic business flow is Inventory Stock Process→Receive / Issue, Receive / Issue History.

- Actual Stock is displayed by Location or Item. If users enter stock of Lot No., users can control stock by Location and Lot No..

- Inventory Stock Process can be done by Location. This Inventory is used to Initial Stock of Accounting.

- At Receive / Issue Entry you can enter Lot No. and Expiry Date.

- Receive / Issue History is create in each process. Stock Card is create by Receive / Issue History. Stock Card has method of FIFO, LIFO, Average.

[Example : Stock Card Report]

Process List

Journal Entry

- Voucher Entry, Received Voucher, Payment Voucher Entry.

- Debit / Credit adjustment function.

- Easy search function of the general ledger and Another account journal history search.

- Input fixed asset, monthly journal processing.

- Print of cash flow to recorded.

- Input processing of bank transaction.

- Input processing of Cheque receipt.

- Input Processing of Cheque payment.

- Fix Journal.

- Create Fix Asset Journal and Recurring Journal.

- Recalculate AR, AP, Bank, Cash.

- Create Periodic Inventory Journal.

- Chart of Accounts, General ledger, Receipt details, Billing details, Journal voucher, Fixed asset.

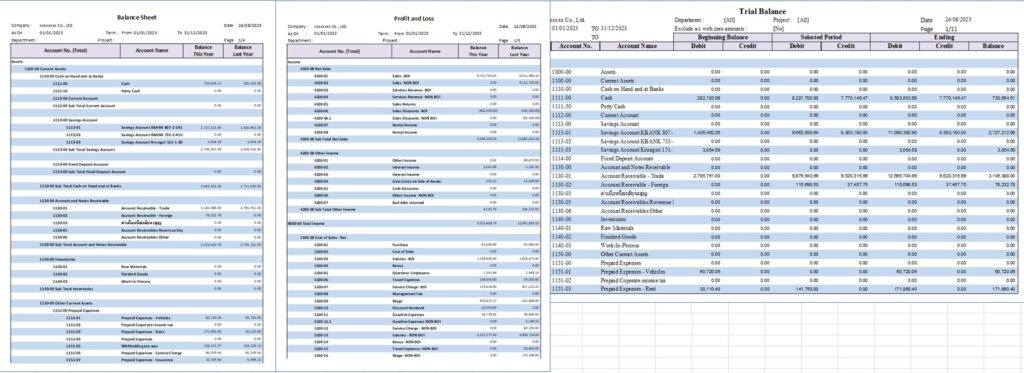

- Trial balance,Balance sheet,Profit and loss statement,Cash flow,Production cost.

- Fixed asset Entry, Fixed asset depreciation details, Fixed asset spreadsheet.

- journal schedule, journal balance, journal summary schedule.

- Bank report, cheque receipt, cheque payment, Returned goods, Returned cheque.

- Customer accounts receivable, Aged receivable detail, Aged receivable summary.

- Supplier accounts receivable,Aged payable detail, Aged payable summary.

- Customer sales details, Item sales details, Sales Tax for Submission to Tax Office, Withholding Tax for submission to Tax Office.

- Supplier purchases details, Item purchases details, Purchase Tax and withholding Tax for submission to Tax Office.

Sales Result of SimLex Accounting System

Since the new release in January 2013, SimLex Accounting has been recognized by many of our customers.

Thailand Sales Result 74 Companies, Accounting Companies use for 42 Companies

Automobile 13 Companies, Electric 11 Companies, Machine 4 Companies, Chemistry 3 Companies, Foods 3 Companies, Service 9 Companies, Warehouse 1 Company, Real Estate 1 Company, Accounting Company 2 companies (30 users), Other 5 Companies

Indonesia Result 10 Companies

Automobile 2 Companies, Medical 1 Company, Service 1 Company, Warehouse 1 Company, Other 3 Companies